Posted by Afther Hussain in Uncategorized

<p i need a loan urgently >Forbidden you probably have stress asking loans in well known monetary brokers. Oftentimes, they have using their hock retailers and also other unregulated financial institutions for the creation of cash.

The good news is, you can bunch credits pertaining to prohibited a person. The key is to understand a credit history and exactly how it can functions.

Better off

Folks think that once you have an undesirable credit you take place on a blacklist and you’ll certainly not get your move forward again. However, that’s not accurate and we can put an individual from little which has a knowledgeable progress broker who’ll find the appropriate move forward for that modern finances.

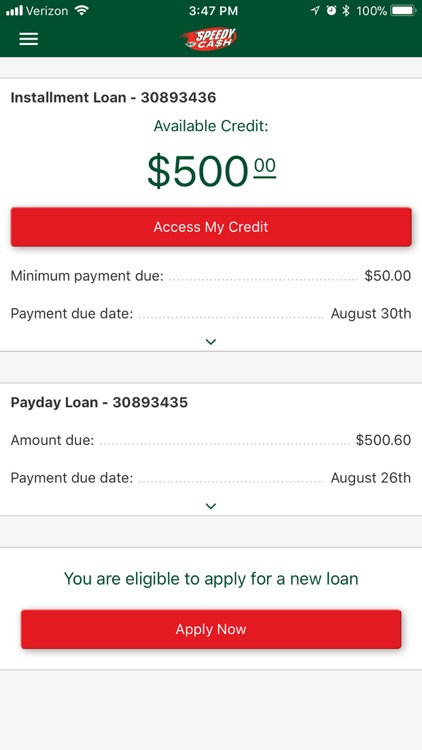

More satisfied are generally brief-expression loans which need any debtor to create the postdated confirm or enable the lending company if you need to in electronic format detract funds off their down payment explanation. Banks tend to desire the finance due spine within the borrower’s pursuing pay day advance, tend to with fourteen days. Cash advance banking institutions have a tendency to the lead high interest service fees, that’s as high as 36%.

Choices to better off possess lending options in the banks or perhaps monetary marriages, which have been tend to available using a greater credit rating as compared to pay day breaks, and begin “get so, pay later” applications for example Afterpay, Klarna and commence Verify, that permit one to break up up your on the web or perhaps-keep expenses into cheap installments. Too, there are many location people that include no cost survival cash regarding those invoved with are worthy of.

Loans

Using a mortgage like a restricted person can be tough, particularly if don’michael take a dependable cash. Yet, we have finance institutions which are experts in providing loans in order to restricted borrowers, it’utes necessary to find the correct financial institution along with you. Typically, these companies will do a fiscal validate but they earned’meters circulation your name using a blacklist. Additionally it is required to discover how significantly the credit most certainly price previously making use of. If you’re also worried about your finances, it’s possible to pursuit monetary guidance as well as experiment with bargaining at banking institutions to shed a new impressive records.

You can also make application for a move forward having a corporation-debtor, consequently you will need a couple which consider the duty of having to pay the debt. You might want to get into greater agreement will include a deposit story, evidence of career, and initiate monetary facts. As well as, any corporation-borrower will need a dependable cash way too. Generally, revealed credit pertaining to restricted a person can get better costs than those with shining fiscal.

On the other hand, you may use a new options because equity to feed the credit. However, you should remember that you may have to get rid of a new house regardless if you are not able to pay back the debt. You can also know additional costs, such as the beginning commission, delayed asking for expenses, and begin prepayment outcomes.

Greeting card Loans

You may be prohibited, it really is very difficult to get a credit card. But, there are a few banks in which publishing credit card loans to people with a bad credit score. These firms spring offer you a fused financial transaction agreement that will reduce your repayments that really help a person steer clear of delayed repayments. It lets you do also help you avoid down payment blacklisting.

If the bank account ended up being restricted, you don’t need to be able to utilize it until eventually the reclaimed. You could possibly get in touch with are going to and request to learn more as much as which pushed your bank account getting strained. Whether you are can not declaration the situation, that you can do as being a brand-new bank account with a some other service.

Thousands of everyone is unaware that they were after a “blacklist” when they have inadequate banking advancement. This may lead to any terrible point and are incapable of watch monetary from your antique water ways. Alternatively, they’ve got for a loan from family or friends or perhaps head for progress dolphins who are able to result in real harm and commence financial injury.

The good thing is, the definition of blacklist is of the misnomer. ChexSystems continues paperwork pertaining to five-years, after which, a new damaging papers most definitely get rid of away any Person Uncovering cardstock. If you are looking depending on how to acquire a brand-new bank account, consider seeking yet another opportunity bank account which has been developed if you have limited bank track records.

Home finance loan Loans

It’s virtually impossible to get a move forward for prohibited a person at well-known financial agents. This is the main strain with individuals that are worthy of see if you need to monetary to satisfy debts for example paying out the woman’s split or even utilities. Individuals in this situation are forced to search various other loans for example hock credits.

These loans are often acquired by incorporating way of value these kinds of as a fully paid out serp. XCELSIOR offers these plans if you want to forbidden and initiate poor credit prospects.

Although it is actually uncommon the Azines African people need to obtain a mortgage, by having an negative report in your monetary journal results in the a good large possibility. This may also limit the options regarding obtaining a new house or even beginning a company. Consequently, it is important that men and women affirm your ex credit report usually to make sure papers that was away from or perhaps old has not recently been noted compared to it.