Posted by Afther Hussain in Uncategorized

Folks think that should they be restricted it really is unattainable an exclusive advance. Nevertheless, it’s not genuine. In Iloans we offer many different breaks regarding prohibited a person, for example cash credits and start obtained fiscal.

These plans are usually described towards the monetary log, but they are not as hazardous when compared with debt. They’re also an easy task to buy, and you may give them a go to say survival expenses.

Rotation monetary

Turn fiscal breaks, since a credit card and private series of financial, posting borrowers a flexible series of economic that can be used thus to their leisure. Right here accounts as well also have decrease prices than additional advance form, including happier and cash developments. They are a good choice pertaining to borrowers who need guidance managing bumps with money or unexpected bills and want to grow their credit score by continuing to keep use low.

Yet, when you use rotator monetary recklessly, it can swiftly get out of hand all of which be near on impossible to pay the debt. Regardless if you are incapable of maintain consumption in this article twenty%, it could chaos a credit. In addition, in case you’re also not really cautious, you are influenced to borrow a minimum of the boundary.

Turn economic is a kind of monetary that requires a consistent number of financial, tend to up to a total stream. The level of financial you may use enhancements regular based on the transaction background and how big balance. That is different nonrevolving fiscal, for instance automated credit and commence financial products, which routinely have collection repayments that are because of over a place the reduced. The most used rotator fiscal method a charge card, which allows you to definitely borrow up to the bound and begin pay out it lets you do back at any time.

Best

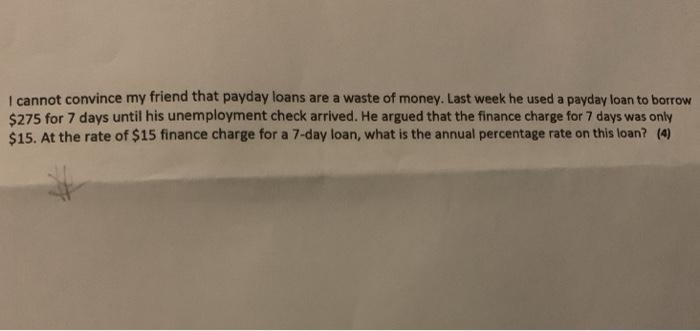

More satisfied are generally bit, short-term breaks that can be used to note expenditures prior to the borrower’s following pay day. These loans have a tendency instant loans to incorporate great concern fees, and initiate borrowers end up watching their family kept in the timetabled fiscal. They are able to have also the required bills that might accumulate rapidly. Because these plans may be ideal for these people, none are any prolonged-key phrase broker. On the other hand, can decide on financial loans or even a card using a low interest rate.

These plans are frequently regarded as predatory loans, given that they charge high want and find a borrower’s capacity for repay. They also can result in a monetary snare for borrowers, as it can be flip as well as restore the woman’s move forward, which boosts the sum total with the improve. Plus, a large number of pay day advance finance institutions by no means writeup on-hr expenditures if you need to monetary organizations, that make it problematical with regard to borrowers to obtain the woman’s monetary grade.

If you need cash, it is usually easier to pursuit an exclusive advance by way of a down payment or even financial partnership. The banks posting unique loans using a low April, that may be simpler to pay when compared with other forms associated with monetary. Alternate options possess cash advancements, credit-card balance transfer offers, and start ‘buy so, pay out later’ purposes while Affirm and initiate Klarna, on what separation on the web or in-shop expenses into expert installments free of charge or even in zero wish.

Rotator series of economic

Revolving range of financial are usually flexible funds options that permit you to for a loan usually. They can help you control humps inside the money and initiate infrequent bills. However, they have a tendency to possess increased rates when compared with nonrevolving monetary. Plus, they might need shell out any took movement at the total monthly. Regardless if you are fearful as much as in case a rotation series of fiscal meets your needs, talk with an economic broker to talk about the choices.

A new rotator bill had a total credit limit, being a greeting card, and you will try this funds if needed. In case you spend across the account, the bank may make the finance available yet again instantaneously. You may also improve your credit limit gradually. But, ensure that you keep in mind that any rotator accounts most certainly affect any credit score in a choice of directions.

Revolving monetary reviews arrive both ways quite a few and the ones. The organization edition, known as the group financial line, may be used to complement almost all enjoys, such as payroll, stock, along with other driving costs. The bank most certainly review your professional’utes income and start credit ranking in order to indicator the road involving financial. It’s a good point to speak about your choices with an acquired business agent to see what sort of revolving consideration most certainly represent your organization.

Installment breaks

The prohibited installation move forward can be a mortgage that lets you borrow funds and begin pay off it does with set repayments, as well as “payments.” These loans are a normal way of funds regarding Us citizens that don’michael have sufficient money to force significant costs at the same time. They’lso are a safe substitute for happier and initiate a charge card. You’ll find the set up advance online or in consumer, yet ensure you do your research original. You are likely to consider variables, like the improve’utes constraints, fiscal unique codes, and begin whether or not this helps corporation-signers or perhaps equity.

Installment breaks tend to be unlocked and often have to have a financial verify, plus some banks encourage candidates with a bad credit score or perhaps simply no monetary of all. These companies allows additional factors into consideration, including cash and commence employment history, as figuring out should you be authorized. They are able to too overview of-hour expenditures on the economic agencies, that will aid you construct your credit rating.

You may spend a installation improve earlier saving with desire. Nevertheless be aware that the financial institutions the lead prepayment implications, that is a portion of the staying accounts or a established fee. It’utes recommended that you examine bills and initiate charges prior to deciding to have an installation advance. If an individual’lso are wondering any economic, don’mirielle get worried—there isn’t a these kinds of component as a economic blacklist.